Omnichannel Opportunities Bring Omnichannel Threats: Prepaid Press Blog

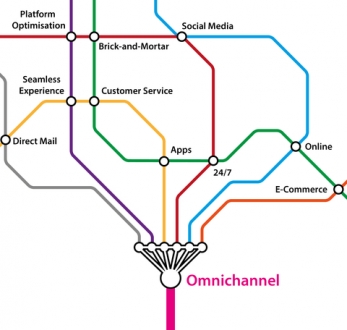

The retail industry has always represented the ultimate promise of uncapped revenues: a cash cow. The sky is the limit as companies are only bound by their imagination in their product offerings. Now, with the digital/mobile age, they’re not bound by the channel of sale, either. But with omnichannel comes a whole new host of digital opportunities and threats. Our somewhat immune vertical

The retail industry has always represented the ultimate promise of uncapped revenues: a cash cow. The sky is the limit as companies are only bound by their imagination in their product offerings. Now, with the digital/mobile age, they’re not bound by the channel of sale, either. But with omnichannel comes a whole new host of digital opportunities and threats. Our somewhat immune vertical

is now facing a myriad of issues in the next year that threaten to reshape how we view the traditional model of retail, payments, and responsibility; beginning with the upcoming US EMV migration deadlines.

There are two issues that will determine retailers’ success as they wade through this new terrain of omnichannel revolution – one is man-made – technology – and one is manPOWER – and although it is good news for retailers everywhere as unemployment continues to decline and consumers have money in their pockets to spend, the impact on retailers’ ability to find and hire the personnel they need to exploit these opportunities is, and will continue to be, a key factor.

Man-made = Technology

Mobile payments and apps are opening up more revenue channels than ever before while companies are collecting and compiling more consumer data than ever. Consumers are anxious and eager to adopt the new channels and ready to make the next leap, even if retailers are more leery when  dipping their toe in the water. The anticipated demand for wearables brings another layer of excitement. There are 168 million wearable devices on track to ship worldwide by 2019, according to a new forecast from Berg Insight. In a landscape where the race is on to break down the barriers between the channels and share as much analytics as possible, can data and card security possibly keep up? Can we stem the rising tide of fraud?

dipping their toe in the water. The anticipated demand for wearables brings another layer of excitement. There are 168 million wearable devices on track to ship worldwide by 2019, according to a new forecast from Berg Insight. In a landscape where the race is on to break down the barriers between the channels and share as much analytics as possible, can data and card security possibly keep up? Can we stem the rising tide of fraud?

Well, the US government has attempted to answer this question for us with the impeding EMV migration deadlines, and no part of our industry is immune. Resistance is futile. The much maligned data breaches of major retailers in the last few years are becoming an all too regular reality. Changes must be made to protect consumers, keep data secure, and reduce fraudulent purchases. As retailers scramble to meet the migration deadlines and have the appropriate hardware in place, the Aite Group tells us that only 70 percent of US credit cards and 41 percent of US debit cards will be  EMV enabled by the end of 2015. In another wrinkle, Missouri recently tested the water with proposed legislation to demand merchants store and track shoppers’ IDs when using mobile payments at a storefront.

EMV enabled by the end of 2015. In another wrinkle, Missouri recently tested the water with proposed legislation to demand merchants store and track shoppers’ IDs when using mobile payments at a storefront.

As far as data security goes, a discussion on RetailWire.com posited the question of whether customer anonymity is even possible within today’s Big Data wave, because, as we all know, the Big Data wave is getting ever bigger. It was reportedthat a recent study showed that technology could be used to identify almost 90 percent of individual shoppers with just four pieces of information, even when names and account numbers were removed. Shoppers were identified through items bought at certain times at certain stores. While they weren’t identified by name, they were recognized as an individual shopper with “x” shopping habits and tastes. This information could easily be used to construct a demographic to target. This may sound very appetizing to retailers at first, but, of course, there will always be those wishing to exploit these new capabilities to enable fraud and data theft.

So, how can retailers find their place in omnichannel and protect themselves? This leads to the second important piece of the puzzle – Manpower.

Manpower = Subject Matter Experts and Salesforce

Now, more than ever, it is critical to hire subject matter experts who can bring these new channels and regulations to bear and spearhead the needed innovations to be EMV compliant at the hardware, card issuing/processing, and retail/merchant level. The payments industry is burgeoning with the need to have compliant software and hardware ready to distribute to the retailers who so desperately need them. Those retailers that have been slow to comply have quite a mountain to climb.

Payments and Retail Technology focused search firms can help find such experts and help companies hire them, whether it be on a permanent or an interim basis. Industry-wide, experts are needed to develop the solutions that will both bring compliance but also bring the real prize, a wonderfully wide and diverse panorama of sales channels that will bring the promise of exponential revenues as they make purchasing easier than ever before. Many retailers are leaning towards having their own payments and CRM teams as they develop their own solutions or just want an expert on hand. Payment and card issuing companies can’t ignore the other key manpower piece – they need a salesforce and sales engineers on hand to get these EMV compliant products into the hands of retailers, and also to develop a strategy encompassing all that is omnichannel. They need experts who can bring omnichannel out of the boardroom and onto the balance sheet of retailers nationwide.

Be sure to check out this blog in its original publication, The Prepaid Press – http://www.prepaidpress.com/features/omnichannel-opportunities-bring-omnichannel-threats.html

Author: Julie Lambert – Admin & Social Media Marketing Manager for MoneyTech Search Group®. julie@moneytechsearch.com